As the benefits industry has evolved, our terminology has struggled to keep up with it. This is especially true with group supplemental health insurance. While many still use supplemental health insurance as a blanket term, we aim to drill down a little deeper to clarify the different sub-categories and capabilities that supplemental health insurance has to offer. What used to be a minor addition to the overall health benefits structure, now plays a larger and more important role.

Use these definitions and summaries to navigate today’s benefits industry and understand the different facets of group supplemental health insurance.

The Basics

Supplemental health insurance is additional insurance that an employee can purchase, or an employer can provide, to help pay for out of-pocket expenses that the primary medical insurance plan does not cover. Put simply, it’s more financial protection for medical costs.

Most supplemental plans provide additional coverage in one of two ways:

- They reimburse for medical expenses that the primary plan doesn’t pay, such as deductibles, copayments and coinsurance. Some plans can even extend reimbursement for care beyond what is covered by the primary health plan.

- They provide a cash benefit paid out per diem over a period of time or given in one lump sum.

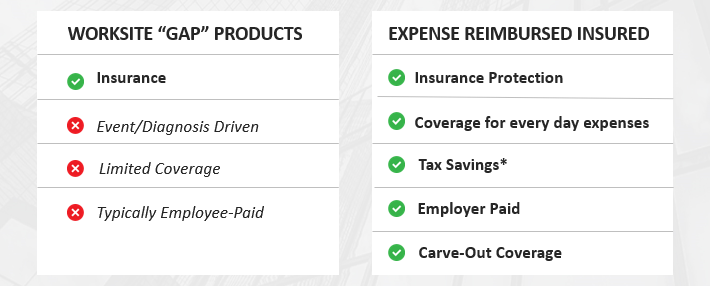

Voluntary Insurance

Voluntary insurance, also known as worksite gap insurance, is a type of supplemental insurance that employees can elect to receive. They are generally employee funded, though the employer may elect to contribute as well. Common voluntary insurance plans are hospital indemnity, critical illness and cancer policies.

An employer may purchase these types of supplemental plans for their employees, but most employers offer these plans on a voluntary basis. This means the employee can elect to purchase the coverage, but it is not required.

People often interchange the words ‘supplemental’ and ‘voluntary’, but these words are not synonymous.

Expense Reimbursed Insurance

Expense reimbursed insurance, also referred to as medical reimbursement insurance, is a type of supplemental insurance that is typically 100% paid by the employer. These plans reimburse employees for their actual incurred out-of-pocket healthcare expenses up to the specified limits of the policy. Unlike employer-paid primary medical plans, this type of supplemental plan can be carved out by employee class.

Key Differences

Limitations

Voluntary Insurance

Though each policy’s conditions are different, these plans only offer coverage when narrow conditions are met. They do not offer true comprehensive medical gap coverage. If the specific event (such as a hospital stay or a specified disease) does not occur, then there is no gap coverage at all. For example, a cancer policy would not cover expenses incurred due to a heart attack.

Expense Reimbursed Insurance

Unlike voluntary insurance, expense reimbursed insurance does not require a specific event or disease to trigger coverage. Instead, employees simply submit claims for their out-of-pocket expenses covered under the plan and receive reimbursements up to the specified limit.

Coverage

Voluntary Insurance

Voluntary insurance plans can technically be considered medical gap plans. However, due to the condition limitations of voluntary insurance, there are times when these types of plans won’t fill coverage gaps. This is often overlooked since these plans are marketed as medical gap plans.

Overlooking this shortcoming can be detrimental and take employees by surprise, leaving them open to financial risk. While a voluntary plan may provide coverage for an unexpected gap, like a hospital payment or cancer treatment, it will likely not provide any coverage for the more everyday coverage gaps, like a routine prescription co-pay gap or a physician visit gap.

Expense Reimbursed Insurance

Unlike voluntary insurance, expense reimbursed insurance fills all types of gaps, like lab work, maintenance prescriptions, physical therapy visits, and dental and vision, without condition limitations. It can fill hospital and cancer treatment expenses, too. Expense reimbursed insurance is a more all-encompassing gap-filler, plugging holes where people more commonly accumulate health expenses like at the doctor. In short, this type of supplemental plan fills gaps all the time, not just sometimes.

Tax-Efficiency*

Voluntary Insurance

Since payment from voluntary plans typically are not based on the actual expense incurred, employees may end up paying taxes on the funds received (if those funds exceed the expenses incurred and depending on how the premium is paid for).

Expense Reimbursed Insurance

Since expense reimbursed insurance reimburses on the actual patient out-of-pocket costs, and therefore creates no potential for additional “income,” reimbursements are generally nontaxable to employees.